In the fall of 2016, 20.5 million students were expected to attend American colleges and universities. These numbers, coupled with an average debt of $37,172 per student puts an extreme pressure on students to begin financing and budgeting for their future.

Many websites and books offer helpful money saving tricks for students. Some of the more simple suggestions include splitting rent, paying bills on time, eating out less, renting books instead of buying, and avoiding impulse purchases. Several of the more substantial tips include opening a savings account that earns interest, avoiding loans unrelated to education, and keeping up on a budget.

“It seems simple, and honestly sometimes it is. The small purchases, the small savings, they add up quickly,” Junior Jake Glaser said.

Of course, there is no one right way to save money.

“I try to keep less than $100 in my checking account and move the rest to my savings account, which I don’t ever take money from,” Junior Joe Huff said.

Others rely on the traditional methods of cash transactions.

“It can feel like I’m not really spending money when I charge something to my credit card, so I try to use only cash. It feels like a tangible transaction,” Junior Walker Pearson said.

“It seems simple, and honestly sometimes it is. The small purchases, the small savings, they add up quickly.” – Jake Glaser ‘18

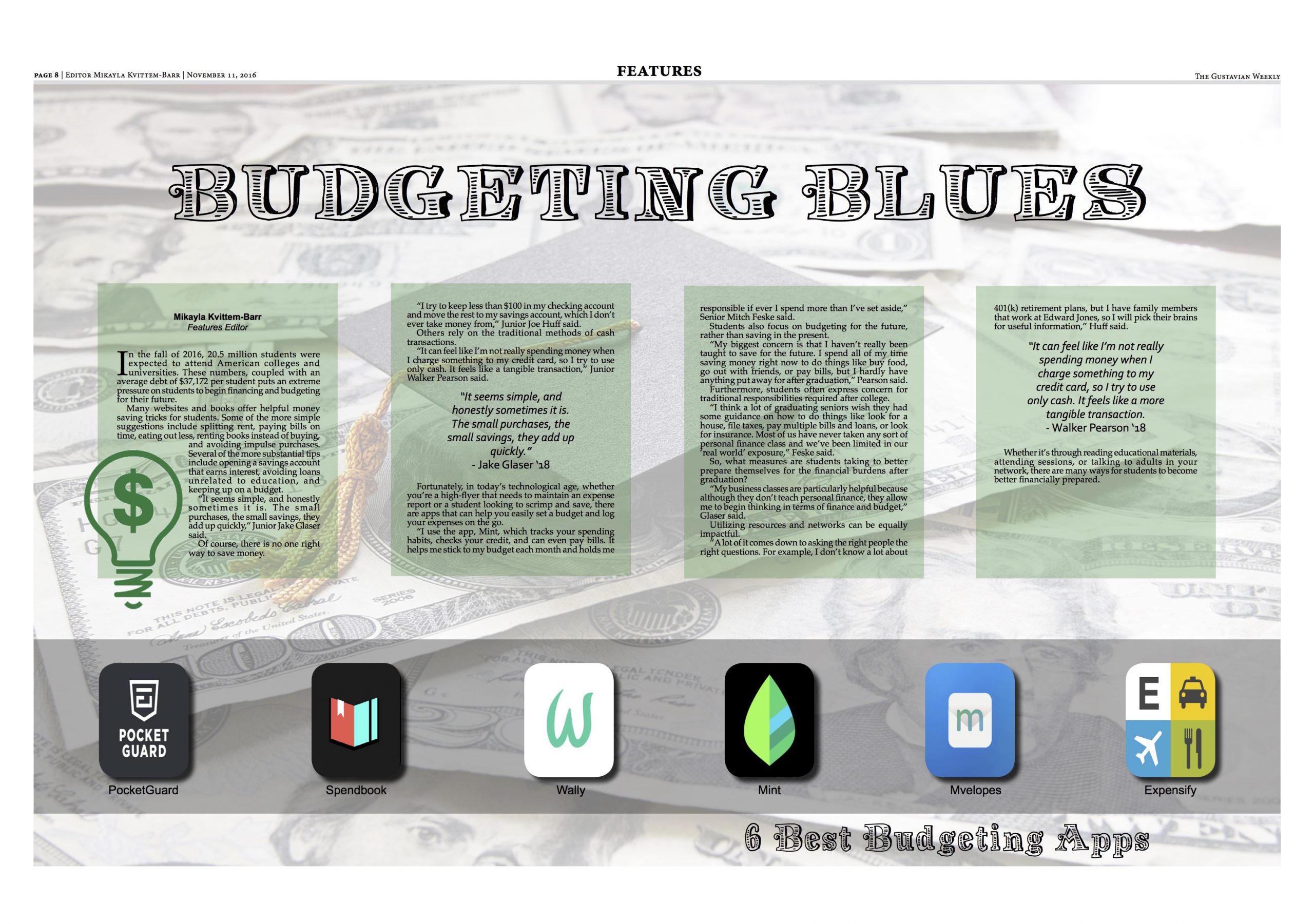

Fortunately, in today’s technological age, whether you’re a high-flyer that needs to maintain an expense report or a student looking to scrimp and save, there are apps that can help you easily set a budget and log your expenses on the go.

“I use the app, Mint, which tracks your spending habits, checks your credit, and can even pay bills. It helps me stick to my budget each month and holds me responsible if ever I spend more than I’ve set aside,” Senior Mitch Feske said.

Students also focus on budgeting for the future, rather than saving in the present.

“My biggest concern is that I haven’t really been taught to save for the future. I spend all of my time saving money right now to do things like buy food, go out with friends, or pay bills, but I hardly have anything put away for after graduation,” Pearson said.

Furthermore, students often express concern for traditional responsibilities required after college.

“I think a lot of graduating seniors wish they had some guidance on how to do things like look for a house, file taxes, pay multiple bills and loans, or look for insurance. Most of us have never taken any sort of personal finance class and we’ve been limited in our ‘real world’ exposure,” Feske said.

So, what measures are students taking to better prepare themselves for the financial burdens after graduation?

“My business classes are particularly helpful because although they don’t teach personal finance, they allow me to begin thinking in terms of finance and budget,” Glaser said.

Utilizing resources and networks can be equally impactful.

“A lot of it comes down to asking the right people the right questions. For example, I don’t know a lot about 401(k) retirement plans, but I have family members that work at Edward Jones, so I will pick their brains for useful information,” Huff said.

“It can feel like I’m not really spending money when I charge something to my credit card, so I try to use only cash. It feels like a more tangible transaction. – Walker Pearson ‘18

Whether it’s through reading educational materials, attending sessions, or talking to adults in your network, there are many ways for students to become better financially prepared.

6 Best Budgeting Apps:

- PocketGuard

- Spendbook

- Wally

- Mint

- Mvelopes

- Expensify