Social Security is without a doubt one of America’s most popular government programs. It has long been viewed as the “third rail” of American politics, meaning if a politician touches it they die.

While a majority want the system to remain as it is, there is a sizable minority (mostly Republicans) who want Social Security to be changed or abolished.

Most believe that Social Security is a key component of the social safety net and a responsibility for the government to provide. Its critics oppose it either for ideological reasons or because they believe the system is unsustainable. The key question is whether Social Security is sustainable, and if not how should it be changed.

Social Security is a pension system, that is, people pay into it while they work and get some back when they retire. There are no individualized accounts; instead, workers pay into the system through payroll taxes. This system works great when there are a large number of income earners supporting a small number of pensioners, as in the 1960s when there were approximately five people paying taxes for every retiree.

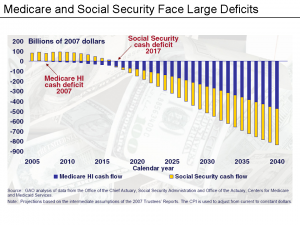

However, this ratio is currently shrinking. The Social Security Trust Fund reports that by 2037 payroll taxes will only cover 78 percent of expected payout. Furthermore, it is calculated that the Trust Fund (composed of money accumulated from revenue surpluses) will be used up by 2037.

Both Democrats and Republicans agree that Social Security needs to be changed, but their proposals for changing it are radically different. The Democrats tend to believe that the solution is cutting benefits for some groups and raising the cap on the payroll tax. In contrast, the Republicans tend to think that the solution is to change a government run program to a private program.

There are problems with both plans. The Democrats’ plan may result in a sustainable program, but it could turn Social Security from a pension program into a welfare program. While this could solve the problem, many Americans would be opposed to turning Social Security into a welfare program and many workers would be reluctant to pay into a program that might not pay them back.

The problem with the Republicans’ plan is that since there are as yet no individual accounts moving to a private system, the government has to foot the bill for the transition period, either by increasing the deficit or raising taxes, which would make workers pay twice. Additionally, the private plan means that retirement income is partly dependent upon the state of the market and can grow or shrink depending on its conditions.

Of the two options the Republicans’ is probably better, though far from perfect. While it would be painful in the short term, it would solve the problem in the long run. There is also evidence that privatizing social security would produce an additional benefit.

Chile changed its pension system from a system comparable to ours to a private system in the 1980s. As a result, wages increased and companies had incentive to hire more workers. While the Democrats’ plan could work, it may just kick the can down the road, especially with payroll taxes down due to the recession.

Without either a substantial increase in workers or decrease in retirees, Social Security cannot remain in its current form, and the sooner the issue is addressed the easier it will be to fix. Unfortunately, it seems that politicians are more afraid to touch the “third rail” than they are about the future of the program, which puts all retirees, present and future, at risk.

*All statistics courtesy of

www.ssa.gov

Excellent thoughts on SaaS. You hit the nail on the head when you said that It cahgnes the power play between the customer and the vendor and assures that the vendors work for the customers every day. My company, SpringCM lives by that creed, not just because we are good people (we are) but because it is a matter of survival and thrival (my made up word of the day). As for security, it is amazing to me that people have no problem trusting their intimate financial data to their online banker or broker, who are in effect practicing the SaaS model. Yet they blanch at the thought of trusting their company’s data to a SaaS application provider especially when the appropriate use of SaaS eliminates the all-too-common security breach of the lost or stolen laptop full of critical corporate data.