We’ve all heard the mantra, “Make the rich pay their fair share!” President Obama and Democrats have picked up on this popular opinion, saying that they want the rich to foot most of the bill for government programs and paying off the debt. However, not everybody agrees with this sentiment, and as an observer it can be hard to tell who is right as neither side likes to list facts and statistics are hard to come by.

There is definite evidence to support the Democrats claim that the rich don’t pay their fair share. Income from investments is taxed at a lower “capital gains” tax rate, which allows one in ten of America’s rich to earn a substantial portion of their income from investments. This means that many rich people pay a 15 percent average tax rate. In contrast, the average tax rate on those earning $1 million or more without the aid of investments is 29.1 percent. This would seem to support the Democrat’s viewpoint that the rich underpay. However, there are other considerations that make the water a little murky.

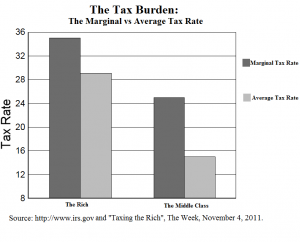

One of the most important things to look at is the average tax rate, not the marginal rate. The marginal tax rate is the tax rate on money earned above a certain amount. For example, $10,000 may be taxed at 5 percent but anything over $10,000 may be taxed at 7 percent. Because most people qualify for deductions (dependents, charitable contributions, etc.) the amount they pay in taxes is lower than what the marginal tax rate would suggest. The amount an income group pays in taxes after all deductions is called the “average tax rate.” The number of deductions that can be claimed goes down as income goes up, meaning that the rich pay closer to their marginal tax rate (35 percent marginal vs. 29.1 percent average) while the middle class and poor pay substantially lower tax rates than their marginal rate would suggest (25 percent marginal vs. 15 percent average). It should also be noted that the average tax rate for the rich is almost double the rate for the middle class.

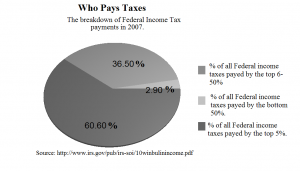

So, is this fair? Is an average tax rate of 30 percent for the rich and 15 percent for the middle class reasonable? The answer depends on what is reasonable, and neither party specifies what they think is a reasonable percentage. A good thought experiment may be to think about what percent of all income tax revenue the top 1 percent, 5 percent, and 10 percent should pay in an ideal, perfectly fair, world. Would it be 5 , 10, 50, or even 100 percent of all income taxes? For added fun, think about what percent the bottom 50 percent should pay.

According to the IRS, the top 1 percent of income earners pay 40 percent of all federal income taxes. The top 5 pay 60 , and the top 10 pay 70. Comparatively, the November 4th, 2011 issue of the Week reported that 47 percent of the U.S. population pays no federal income tax.

Considering these numbers, it might be hard to say that the rich don’t pay their fair share. Yes, there are people who pay less than they should, or don’t pay at all, but that is true at all income levels, not just the higher ones. When 5 percent of the population pays 60 percent of all income taxes and 47 percent of people pay no income tax, it may be unfair to claim that the 5 percent aren’t paying enough. There are certainly good arguments for the rich to pay more, but they should not be presented under the guise of “fairness.” I for one would appreciate the honesty.

I disagree, but I am not angered by President Obama’s claim that the rich should pay more. But claiming that the group paying most of the income taxes are, in essence, free riders irks me when almost 50 percent of the nation is paying no income tax at all. It seems unfair to me that so many people accuse the rich of not paying their fair share, when it may be more appropriate to thank the rich for footing the nation’s bills. Is it too much to ask for a little honesty in government? Oh yeah. Maybe it is. Nevermind.

The current Income Tax system has been falling apart for years.

Even CPA’s and tax preparers do not understand the Income Tax system, as evidenced by the different answers you get to the same questions about how to report various income transactions.

Just look at the enormous amount of tax court cases where people pay money to argue with their government over what is deductible, what is not deductible, what can be carried forward, what can be carried back, what are the facts and circumstances surrounding the income and/or deductions, etc. etc.

If this 75,000 page income tax code was clear and understandable, there would be very little arguments over much of anything!

So instead of people spending their time making money, they end up spending time and money figuring out how to comply with the government’s bookkeeping requirements, which change every single year!

The current Income Tax system is a horrid mess and hurts everyone.

The legeslation is always complex and open to interpretation that is why we have tax specialists and tax rulings.

the general bookkeeping requirements do not change and bookkeepers are not required to know the tax rules,only GST.

The tax issue continues to plague our country and the frustration is that there has been answers out there for many years. The problem is that neither political party wants to change anything. The 2 best answers to our broken and UN-fair tax system are: 1. The FairTax (fairtax.org) Completely eliminates all income tax which is needed to stop punishing the productive, helps the poor rise in the economic ladder and will make our country competitive again. Trillions of dollars now parked offshore will be repatriated. Our economy would prosper, also the illegal immigrants will be paying into the system as they need to buy things.. I would say then, fine let the in! As it is now they are draining our resources without paying their FAIR SHARE into our tax system… and 2. The Flat Tax… this helps people and business plan for their tax burden and eliminates years in court prosecuting and defending poorly written tax code that has more grey areas than definite understanding. The current tax code is insane and wasteful.

Why can’t people see that Flat Tax will never be accepted… Our complicated tax code is there so congress/government can influence (control) citizens behavior. Since both parties do everything they can to cram their views down American’s throats, neither party will relinquish their power for the good of the American population.

-just an average American house wife’s opinion; whose voice is as a drop of water in the ocean and whose vote truly doesn’t make a difference because of the ingenious electorial college.

Shelley, it is true that to establish a common sense tax system be it flat or FairTax is an uphill push for sure. And it is true that both party’s do not seem to be helpful. This is why I changed from Democrat to Independent and have strong respect for the Independent TEA party people. They seem to demand responsibility from elected “servants”. But you are not just a drop of water, every vote counts. I don’t know if a Romney administration will fix the mess but I sure know that we can’t afford any more years of the current nut case. Government “service” seems to draw mentally ill people who have a strange need to control people rather than get off our backs and just create a safe environment from which we can live our lives and raise our kids. The best we can do perhaps is to let our elected “servants” know they can never take any vote for granted.

You know just one example of mentally ill “servants” like to pull on everyday people is this class warfare crap. The most recent attack has to do with the 15% investment tax. Ohhh, how terrible! Of course don’t remind people that it is that very tax level which affects our pension and retirement benefits ! Raise that and many more elderly will face an early death due to not having the necessary resources to live. Now what was that I was saying about mentally ill “servants”? Of course these nut cases do not wish to remind us of that little inconvenient truth. They just want to get people worked up so they can pass laws to take away that which will help us and redirect (redistribute) that money (our money) to building government even larger.

It is a good thing that we do not get as much government as we pay for.