“What drags our entire economy down is when the benefits of economic growth and productivity go only to the few … the gap between those at the very, very top and everybody else keeps growing wider and wider and wider and wider.”

So read the President’s teleprompter as he spoke in front of a rally in support of his “Buffet Rule” proposal last week. The President presented his idea to reshape the nature of our tax code and to reelect himself to another term.

The Buffet Rule, named for Warren Buffet, longtime inhabitant of the Forbes “richest people in the world” list and longtime payer-of-less-taxes-than-his-secretary, is a simple concept:

If you make over a million dollars, you should pay at least as much in taxes as most middle class Americans. If you are like 98 percent of American families who make less than $250,000 a year, your taxes shouldn’t go up.

However much sense this might make, by the time this article is published the proposal will have been filibustered in the Senate, and President Obama knows it.

Why then, did he spend the whole week publicizing the vote? Is it because he honestly believes it to be a significant step toward reducing the deficit? Surely not, as even liberal think tanks estimate the revenue generated by this proposal will not exceed 50 billion dollars per year, barely a drop in the bucket.

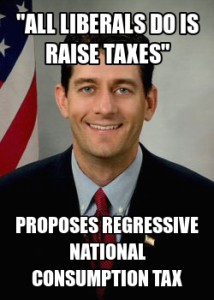

No. This is something more sinister, or brilliant, depending on what side you want to take. The Buffet Rule’s singular purpose is to reflect the President’s reelection theme of fairness and justice in the economy. It shows a distinct contrast with the budget introduced a few weeks ago by Paul Ryan, the influential Wisconsin Republican and Chairman of the House Budget Committee, who calls it the “Roadmap for America’s Future.”

For the second time in three years, Ryan has proposed a budget he knows won’t pass either. The last time around it proved politically problematic for Republicans because of its drastic austerity measures and cuts to entitlement programs that scared many who depend welfare. One Democratic campaign ad even featured a Paul Ryan look-alike rolling an old woman off a cliff in her wheelchair.

So why would the President and House’s leading Republican both propose oversimplified and exaggerated versions of their economic philosophies knowing that they don’t stand a snowball’s chance in hell of getting through the Senate?

Because it forces their opponents to oppose them.

Democrats look like the typical tax and spend liberals by opposing deficit reduction and entitlement reform, and Republicans look out of touch for opposing a “fairer” rate on the super rich. This way, each party is forced back into its traditional corner of the political arena.

These budgets, far from being serious proposals to solve the nation’s financial problems, are methods of political posturing in an election year defined by each side’s effort to control the terms of the debate over the size, scope and purpose of government.

In Ryan’s words, the 2012 election is a clearly defined and fundamental choice between two futures, and it affects all of us, whether we like it or not.

America is a land of taxation that was founded to avoid taxation.