There has been a great deal of political posturing the last year or so over the national debt. Both sides agree that the deficit and the debt need to shrink. Unfortunately, that is where their agreement ends.

The Republicans maintain that the only way to shrink the debt is through program cuts alone, while the Democrats believe that some programs will need to be cut and taxes need to be raised, almost exclusively on the wealthy. Both parties maintain that their approach is the only reasonable one and that the other’s plan wouldn’t work. So the question is, whose plan is better?

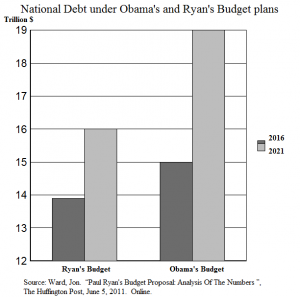

The two principle budget proposals show this split well. House Budget Chairman Paul Ryan’s (R-Wis.) budget is back and, while somewhat changed, still aims to cut social programs without raising taxes at all (Jon Ward, Huffington Post, June 5, 2011). While the Republicans claim that it will reduce the debt to safe and sustainable levels, the Democrats strongly oppose this proposal, and President Obama recently released his own budget plan. His plan included some cuts and increased taxes on select corporations, individuals earning over 200,000 dollars and couples making over 250,000 dollars (Lisa Mascaro, LA Times, Mar. 16, 2012).

A study by the Congressional Budget Office’s recently estimates that President Obama’s budget would do little to solve the debt crisis. They calculate that Obama’s budget would add about 4 trillion dollars to the national debt and would increase the percentage debt to GDP (a measure of a country’s economic health) from 68 percent to 76 percent over a ten year period (Mascaro).

While this increase does not put the U.S. in the same category as Greece (at 135.2 percent), it is still dangerous. Spain, another European country with a looming debt crisis, has a debt to GDP ratio of 70.1 percent (www.economist.com).

Furthermore, it is unclear whether raising taxes on the wealthy would result in substantially more income. A recent study reports that when taxes changed on the top tax bracket there was little change in the amount the government took in because the wealthy shifted their behavior to minimize their taxes (The Economist, Jan. 21, 2012). Without a complete overhaul of the tax system that would close many existing loopholes, it is unlikely that the increased taxes would have a substantial effect on government revenue.

Although the President’s plan seems to do little to address the current deficit problem, Ryan’s plan is not much better. Ryan’s plan is problematic for a variety of reasons, first and foremost it would never be passed without a Republican super majority in the Senate and a Republican president. Secondly, it would be of limited help. It would “only” add 2 trillion dollars to federal debt and its revenues would only exceed expenditures starting in 2040 (a little better than Obama’s plan) (Ward). Finally, it too is based on rosy assumptions, tax cuts causing economic growth, the President’s health care law being repealed, the closing of tax loopholes, etc.

These plans might work, but the evidence of tax cuts on economic growth is mixed, and although everyone always claims that they are “fixing loopholes,” they always seem to remain. It is fully possible that government revenue would stay the same or even shrink under Ryan’s plan.

It seems neither President Obama’s nor Ryan’s plans are effective budgets that would get the deficit back under control and are just more political posturing. Unfortunately, this is an issue that cannot wait as the growth of the national debt is unsustainable.

There is a solution: cut programs and raise taxes; not just on the rich but on the majority of citizens. If the Bush tax cuts were ended on all income groups and automatic spending cuts were implemented, the deficit would grow by substantially less than 3 trillion dollars over the next 10 years, which is much less than under Ryan’s or Obama’s plan (3 and 6 trillion, respectively) (Ward).

While it is possible that increased taxes would have a detrimental effect on economic recovery, this is the price America may have to pay to regain its fiscal footing. However, this seems unlikely to happen, as the Democrats oppose tax increases on anyone but the wealthy and the Republicans oppose tax hikes on anyone. So, as Congress remains in partisan gridlock, our nation creeps ever closer to fiscal chaos.

This site is nice and amazing. I love your post! It’s also nice to see someone who does a lot of research and has a great knack for ting, which is pretty rare from bloggers these days.

Thanks!

pilot license

Income tax returns are the most imaginative fiction being written today.